Purplle's FY24 Sales Zoom 43% To INR 680 Cr, Loss Almost Halves

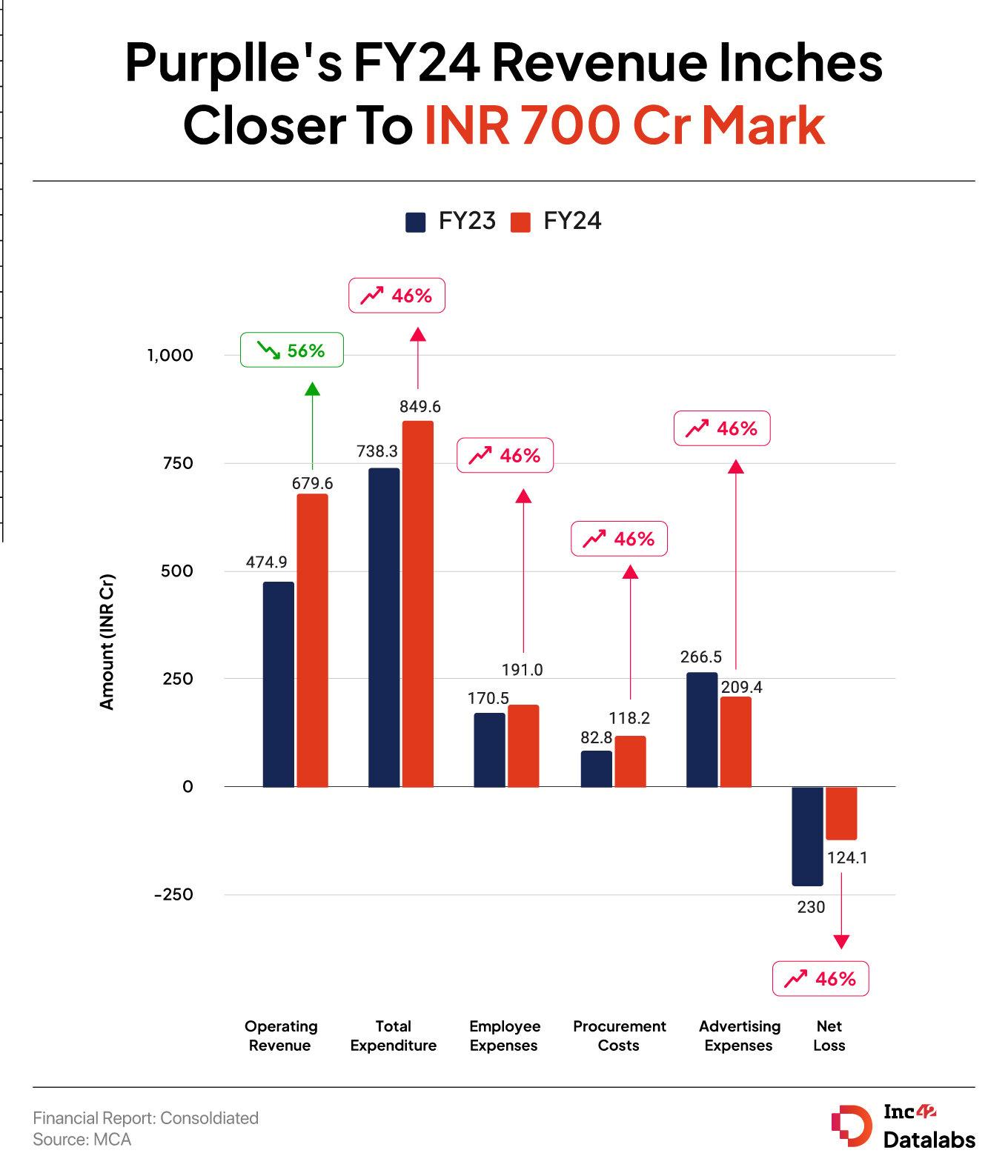

Mumbai-based beauty ecommerce marketplace Purplle’s revenue inched closer towards the INR 700 Cr mark in the financial year ended March 31, 2024. The Abu Dhabi Investment Authority (ADIA)-backed unicorn reported an operating revenue of INR 679.6 Cr in the financial year 2023-24 (FY24), an increase of 43% from INR 475 Cr in the previous fiscal year.

The ecommerce marketplace primarily earns revenue through listing of products on its website. It earned INR 392.9 Cr through this in FY24, an increase of 72% from INR 227.9 Cr in the previous year.

Besides this, income from sale of products rose 16% to INR 286.65 Cr during the year under review from INR 247 Cr in FY23.

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle sells beauty products and appliances. It sells products of several D2C brands, including Plum, WOW Skin Science, mCaffeine, Maybelline and SUGAR Cosmetics, on its platform. Beside, it also sells products under its private labels – Faces Canada and Good Vibes.

Purplle managed to reduce its cash burn during the year under review, as a result of which its net loss plummeted 46% to INR 124.1 Cr from INR 230 Cr in FY23.

Despite the 43% increase in its top line, Purplle’s total expenditure rose only 15% year-on-year. Its expenses stood at INR 849.6 Cr in FY24 as against INR 738.3 Cr in the previous fiscal year.

Advertising Expenditure: Being an ecommerce marketplace, one of the biggest expenditures for the startup is advertising cost. At INR 209.4 Cr, Purplle’s advertising expenses accounted for 25% of its total expenses in FY24. However, the startup lowered the spending on advertising by 21% compared to the INR 266.5 Cr it spent in FY23.

Procurement Cost: Purplle spent INR 118.2 Cr under this head, an increase of 43% from INR 82.8 Cr in FY23.

Employee Cost: Employee benefit expenses rose 21% to INR 191 Cr in FY24 from INR 170.5 Cr in the previous fiscal. This is an indication that the startup increased its employee headcount during the year.

Purplle’s EBITDA margin improved to -12.5% in FY24 from -41.6% in FY23.

Earlier this year, the startup bagged INR 1,000 Cr in a funding round led by a subsidiary of ADIA. The round was a mix of primary and secondary share sale and valued the startup at its last valuation of about $1.2 Bn – $1.3 Bn.

Purplle has raised a total funding of about $400 Mn till date and counts the likes of Peak XV Partners, Premji Invest, and Ranjan Pai among its backers.

The post Purplle’s FY24 Sales Zoom 43% To INR 680 Cr, Loss Almost Halves appeared first on Inc42 Media.

READ ON APP