HDFC UPI Limits: How To Increase Your Daily Transaction Limit

The Unified Payments Interface ( UPI ) is a unique innovation by the National Payments Corporation of India (NPCI) that allows you to send and receive money from any bank account. UPI makes online transactions easy and time-saving.

HDFC Bank customers can use the UPI facility once they register by following the guidelines. However, UPI has transaction limits, and you cannot make more transactions once these limits are reached.

HDFC Bank customers can use the UPI facility once they register by following the guidelines. However, UPI has transaction limits, and you cannot make more transactions once these limits are reached.

Keep reading to learn everything about the HDFC UPI limit and how to ensure a hassle-free transaction experience.

HDFC UPI Limit

UPI transactions are reaching new records every month in India due to their simplicity and convenience. The NPCI has set several guidelines to regulate the digital payment ecosystem in the country, stating that an individual can transfer a maximum amount of Rs. 1 lakh via UPI in a day. However, HDFC Bank has specific limits for its customers availing UPI transactions.

HDFC UPI Transaction Limit

The HDFC UPI transaction limit is up to Rs. 1 lakh per day or 20 transactions for individual-to-individual and individual-to-merchant transactions within 24 hours. New UPI users can initiate transactions up to a maximum of Rs. 5,000 for the first 24 hours for Android users and 72 hours for iPhone users after registration. The limit remains the same regardless of the UPI application used.

If you have exhausted your daily transaction limit, you will have to wait until the next day to make further transactions.

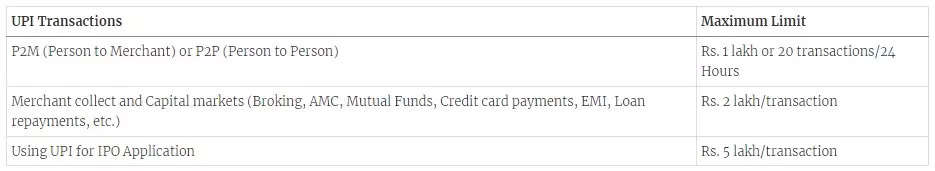

The table below provides the HDFC UPI limit for different scenarios:

HDFC UPI Transaction Limit per Month

HDFC Bank does not have a specific monthly limit for UPI transactions. However, adhering to the daily transaction limit ensures a hassle-free experience. Keep an eye on HDFC Bank's official site for any updates to these limits.

HDFC UPI Transaction Limit per Year

There is no specific yearly limit for UPI transactions for HDFC customers.

HDFC UPI Transaction Limit Change

There are no charges for UPI transactions for HDFC consumers. However, according to new UPI guidelines, a 1.1% interchange fee applies to merchants for UPI transactions exceeding Rs. 2,000 made via Prepaid Payment Instruments (PPI).

How to Increase UPI Limit in HDFC?

The maximum limit is Rs. 1 lakh per day, and for new UPI users, the limit is Rs. 5,000 for the first 24 hours from registration. This limit cannot be increased manually. However, as per a recent notification, the RBI has decided to increase the amount to Rs. 5 lakh for educational fees and hospital bill transactions.

Overall, UPI makes online transactions easy and secure for everyone in the country. Each bank has UPI limits to regulate the expanding digital payment ecosystem. HDFC Bank does not allow you to manually increase the limit. Now that you have a clear understanding of HDFC Bank's UPI limit, ensure you complete transactions accordingly to avoid any hassle.

Next Story

READ ON APP